You may be aware that we are in a bit of a situation. We have recently come out of the deepest recession in our nation’s history since the Great Frost of 1709, and while we are set to avoid a double-dip recession, we are now faced with the biggest challenge in over half a century. The UK government has racked up an estimated £400 billion deficit this financial year, and our national debt is at a historic level of 100% of GDP. The vaccine rollout has been a success so far, and the Treasury will now set their sights towards the economic recovery. There are essentially two directions to go: to spend or to save. Before we decide which is the better route, it is worth looking across the pond at the newly elected Biden team’s plans for economic recovery.

President Biden and Janet Yellen, his Treasury Secretary, have been advocating a $1.9 trillion fiscal stimulus package. This would come on top of a $2.4 trillion stimulus signed into law last March and a $900 billion relief package that passed in December. To put things into perspective, the UK has spent around 6% of GDP on fiscal support solely for Covid. This is comparable to Italy at 7% and Germany at 9%. By contrast, the USA has already spent 15% of GDP, and Biden’s plan would increase this to a whopping 24% of GDP. Moody’s Analytics forecasts that US GDP growth will be around 8% in 2021 if Biden’s bill passes in March, almost double the growth that would be expected without any additional stimulus. There are very influential economists on both sides of the debate. Paul Krugman, winner of the 2008 Nobel Prize in Economics, is an avid supporter of the plan. He argues that the traditional Phillips curve is not working, meaning the traditional link between low unemployment and high inflation seems to have broken down. This means it’s safer to go too big than to go too small, as it’s unlikely to cause overly high inflation. On the other hand, Olivier Blanchard, former Chief Economist of the IMF, disagrees. He has estimated the US output gap to be $900 billion and estimates the mean government spending multiplier effect to be 1.2. This means Biden’s plan will far surpass what is necessary and will lead to significant overheating of the economy.

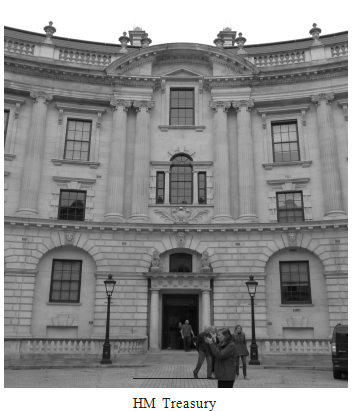

Rishi Sunak, Chancellor of the Exchequer, plans to go in the other direction. He has clearly signalled that he intends to begin reducing the deficit and bring Britain’s public finances back to a “more sustainable footing” sooner rather than later.

He told some of his Conservative colleagues that he wants to make fiscal discipline a “dividing line” with the Labour Party at the next election in 2024. In recent weeks, the media has been rife with rumours of the Treasury looking at all sorts of potential tax rises including “stealth tax raids” on income tax, increases to capital gains tax or corporation tax or higher fuel duty. As I will now explain, I believe this is a move in the wrong direction and that there should be no deficit reduction programme in the near future.

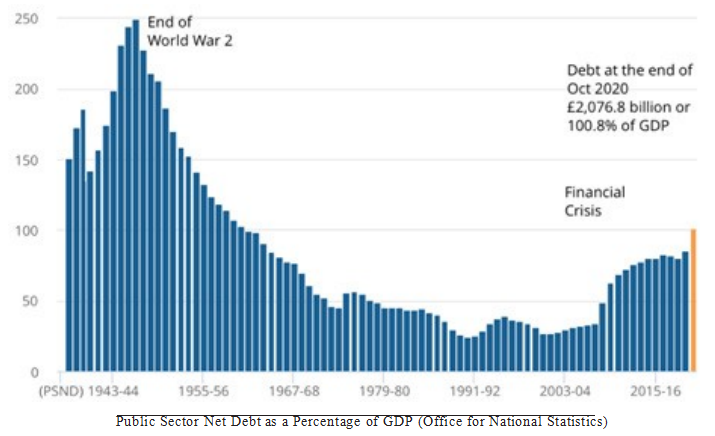

Our national debt has crossed 100% of GDP for the first time since 1960. This may sound like a shocking figure to you, but you may be even more shocked to find out that despite this level of borrowing, the annual cost of servicing the debt is actually lower than it was before the pandemic hit. Debt interest repayments have actually fallen from 3.5% of GDP before Covid to 1.7% of GDP now, the lowest it has been in over 70 years! One reason for this is the historically low interest rate of 0.1% which has lowered the market interest rates and reduced the cost of borrowing. Another, far more significant, reason is the huge scale of the Bank of England’s Quantitative Easing programme. In the last three quarters of 2020, the Bank of England purchased £300 billion worth of government bonds, which seems rather close to the £302 billion increase in the public sector net debt over that same time period. They have already decided to do a further £150 billion of Quantitative Easing, which will happen over 2021. The government pays much less interest on bonds owned by the Bank of England than other investors, significantly reducing the cost of borrowing. Additionally, in April last year the Bank of England agreed to a Treasury demand to directly finance the state’s spending needs via monetary financing using the “Ways and Means facility” if necessary. This is a big taboo in the world of central banking, as monetary financing is what caused the hyperinflation we’ve all heard about in Zimbabwe and the Weimar Republic. Ultimately, the government did not have to resort to this as it was able to borrow all the money it needed without the cost of borrowing rising. This shows, however, that the Bank of England is committed to helping the government spend money by minimising the cost of borrowing.

After the cost of borrowing, the biggest fear economists haveaboutalargescale stimulus programme is high inflation and the risk of going back into a 1970s-style stagflation situation. This required very harsh contractionary policies, both monetary and fiscal, and the iron will of Margaret Thatcher to sort out. Historically, inflation has been the biggest fear of economists and leaders alike. President Nixon in 1971 announced a freeze on all prices and wages in America for 3 months. Ronald Reagan in 1978 described inflation as being as “violent as a mugger” and “deadly as a hit man”. Currently though, inflation seems like an issue of the past. In recent decades, the UK has been struggling with lacklustre inflation that’s unable to meet our 2% target despite a decade of near zero interest rates and the printing of hundreds of billions of pounds via quantitative easing. In 4 of the last 20 years, inflation hasn’t even managed to meet the 1% lower limit of the inflation target and it is currently only 0.7%. This seems set to continue with the OBR forecasting lower than 2% inflation for at least the next three years.

Somewhat heretically in today’s economic environment, I would argue that higher inflation isn’t a major issue, as long as it is stable. The 2% inflation target that the Bank of England reveres is nothing but an arbitrary number which was chosen because it’s low, but not low enough that targeting it is likely to cause an unwelcome bout of deflation. High inflation helps the government by eroding away at the real value of the debt it holds. In fact, the main reason the national debt fell so rapidly from over 230% of GDP in 1947 down to just 50% of GDP in 1973 was a combination of high economic growth with an average of 3.5% GDP growth per year combined with a high average inflation rate of 5% per year. By contrast, the austerity policies of the 2010s did succeed at reducing the deficit from 10% to 2% of GDP, but the national debt actually rose from 63% to 81% of GDP which clearly highlights the failure of austerity as a debt reducing measure. If the last decade has been one big economic experiment, the results are in and the conclusion should be to never repeat it again.

Therefore, perhaps the 2% inflation target should be raised. This would allow the Treasury to embark on a fiscal stimulus programme without worrying that the Bank of England will be forced to raise interest rates, which would limit the effectiveness of the spending and, even worse, raise the cost of the debt burden. Furthemore, this would reduce the constraining effect of the liquidity trap as increasing the inflation target will increase the expected inflation rate. For any given nominal interest rate, this will give a lower real interest rate, giving the Bank of England the ability to utilise more expansionary monetary policy than it currently has the ability to. While it is true that the Monetary Policy Committee is independent, the Bank of England’s remit is still designated by the Chancellor of the Exchequer and he can unilaterally alter the inflation target. Rishi Sunak has suggested that the reason he is worried about borrowing too much is that he doesn’t have a “perfect crystal ball” about how interest rates will change. If he were to raise the inflationary target, or at least provide the Bank of England more flexibility so that they don’t enact contractionary monetary policy in the near future, he wouldn’t need to be so worried. This would not be without precedent. 6 months ago, the US Federal Reserve abandoned its traditional inflation targeting and adopted “average inflation targeting” which means that in the long run, the inflation rate in America has to average out to 2%. This was done because their inflation rate has been below 2% for most of the last 12 years, so now the Federal Reserve has the flexibility to allow inflation to rise above 2% without having to use contractionary policies to bring it down.

The next question would be, if this fiscal stimulus were approved in the UK, what should it be spent on? I find Biden’s plans to give each American a $1400 stimulus check wasteful. It’s not enough support for those on low incomes or who have lost their jobs, while it’s unnecessary for workers who are still employed and earning the same as before the pandemic. I would instead renew focus on the “productivity puzzle”

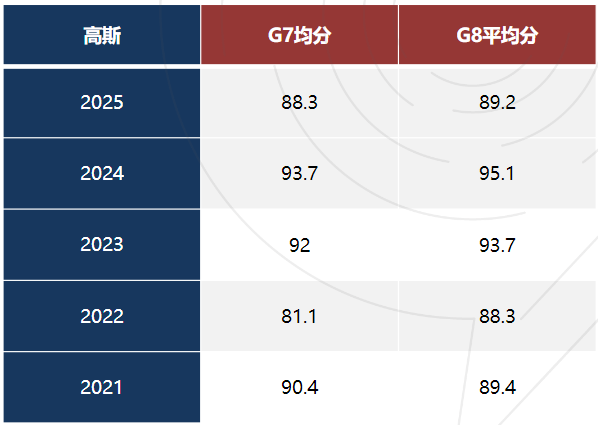

facing the UK economy. Within the G7, the UK has had the second lowest rate of productivity growth over the last decade, the lowest amount of investment and the second lowest amount spent on research and development as a percentage of GDP. While correlation doesn’t necessarily imply causation, I would be very surprised if these all just happened by unfortunate coincidence. We also have a long term commitment to achieve net zero carbon emissions by 2050. PwC has estimated that to deliver on this promise will require £400 billion of investment in the next decade. Here we have a perfect opportunity to kill three birds with one stone. Borrow money while it’s still the cheapest it’s ever been and invest it. Invest in research and development. This will increase the rate of technological progress helping to increase productivity, incentivise firms to invest in capital and help make our ambitious climate goals more attainable. In 1996, Tony Blair famously said his three main priorities in government would be “education, education and education”. Perhaps it would be a good idea for the Johnson government to make its motto “investment, investment and investment”.

It may be worth mentioning that the IMF, the World Bank and the OECD are urging countries to spend their way out, and not to worry about their public finances. You may question why we should listen to these organisations when merely 10 years ago they were cheering on austerity policies as a way to recover from the Great Recession, before realising far too late that perhaps that was bad advice. The difference is that the IMF and World Bank have always subscribed to the Washington Consensus of free market policies including privatisation and spending cuts. However, when even the IMF, the bastion of free market policies, advocates a Keynesian response for the recovery of this recession, even the staunchest fiscal conservative should be reconsidering their view. It is also probably unfair to blame economic institutions for making an incorrect economic prediction. After all, I am writing in a magazine called “The Dismal Scientist”.

Perhaps there are two versions of Rishi Sunak. The first is the energetic, innovative Chancellor we’ve all seen on our TV screens for the last year who is willing to borrow and spend when it’s what is best for the country. The one who announced an unprecedented scheme to pay the wages of millions of workers across the country. The one who effectively handed the NHS a blank cheque to cope with the pandemic. The one who subsidised meals by 50% in an effort to save our dying hospitality industry. The second is the ideological politician which The Economist implied is a reincarnation of Thatcher. A dry Tory with a penchant for balancing the budget. Sir Keir Starmer, leader of the Labour Party, agreed when he said that the government interventions spearheaded by Mr Sunak were a matter of “necessity, not values” and that Sunak’s instinct is “how quickly can I extricate myself from this”.

We are in the toughest economic situation in decades. Any number of incorrect moves has the capacity to cripple the economy. In a time like this, we need a pragmatist who is above petty ideological disputes. Someone who will put the needs of the country before the party. Someone who will not return us to the austerity of the 2010s, but instead allow himself to be influenced by the Biden-esque policies of large fiscal stimulus, with innovative policies to mitigate the inflationary risk. Mr Sunak is in a uniquely advantageous position to announce a big fiscal stimulus. YouGov opinion polls show that he’s consistently been the most popular British politician since he became chancellor, and even more impressively he’s the most popular amongst every age group and gender. He’s earned a lot of goodwill from both the public and the media and therefore has the political capital to try to pull off something that few other Conservative politicians would ever dare.

The measures in the March Budget, which will have been announced by the time this article goes to print, are likely to focus on continued emergency support due to the ongoing lockdown such as a short extension to the furlough scheme. We will likely only see the true Mr Sunak in his second November Budget when he will be in the unenviable position of choosing how to shape the British economic recovery. Let’s hope we get the first Rishi, not the second.