本文选自2023年3月13日的Financial Times,原作于The Editorial Board。

最近上经济课的时候和很多同学聊到硅谷银行(SVB)倒闭的问题。相信所有看到这个消息的人都很难不把它和2008年的雷曼兄弟事件做联想。本文就很好地介绍了SVB倒闭和美国宏观经济政策的关系,以及它应当给政策的决定者们带来什么样的启发。

新闻节选

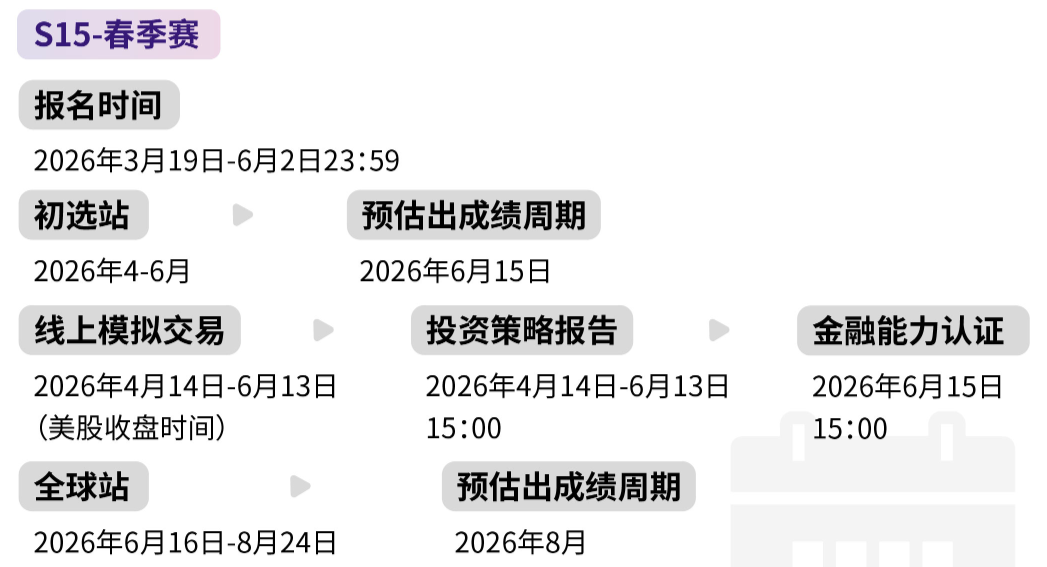

Commercial banks were supposed to be big beneficiaries of rising interest rates, but that assumed they managed their balance sheets sensibly. Silicon Valley Bank did not. As a result, the Californian lender to start-ups on Friday became the second-largest bank collapse in US history. Signature Bank, the third-biggest collapse, followed within hours. Authorities on both sides of the Atlantic scrambled over the weekend to limit the fallout. Their actions staved off worst-case scenarios, but systemic risks to markets and the economy remain, and it is regrettable that what amounts to a bailout was needed at all. Widely-flagged vulnerabilities caused by fast-rising rates were allowed to boil over — by both banks and their regulators. Lessons must be learnt.

SVB was particularly exposed to higher rates. Deposits soared as money poured into start-ups when rates were still low, which the bank invested in mortgage bonds and Treasuries. But no economic regime lasts forever. The US Federal Reserve jacked up rates by 450 bps in a year to tackle inflation. SVB’s bond portfolio dropped in value and deposits were trimmed as VC funding dried up. To meet outflows it had to sell its bond holdings at a loss, leaving a hole in its balance sheet. Its collapse has sparked fears over similar regional banks, which are less heavily scrutinised than the largest US lenders. Large institutions, while better hedged and capitalised, also face losses. The US banking system has more than $600bn in unrealised losses on investment securities.

The authorities responded rapidly and extensively — but that they needed to is a reflection of monitoring failures, especially with regard to smaller banks. The US decision to guarantee all deposits at both SVB and Signature, even above the mandated $250,000 threshold, helped calm a sense of systemic panic. A generous Fed liquidity facility will allow banks to exchange assets as collateral for loans at par value. However, funds will be covered by a bank levy, not by taxpayers, and there will be no support for shareholders or certain unsecured debtholders. Meanwhile, SVB’s UK subsidiary was snapped up by HSBC, guaranteeing deposits without official intervention.

Rapid action was needed; in the digital banking and social media age, a single tweet can set off a bank run. But what came was far from ideal. Making depositors whole, along with the new liquidity facility, creates enormous moral hazard. It encourages banks to be less accountable to depositors and protects them from interest rate losses.

Rising interest rates are no act of God. The root problem here, SVB’s defective risk management, is rightly in the spotlight. It is fair that tech firms — and their employees — are protected from such negligence. But central banks and regulators are to blame for failing to inculcate better standards, and paid far too little attention to interest rate risks. These were obvious well before the UK pension market crashed because of a surge in bond yields in September. Arbitrary regulatory thresholds based on total assets, which left SVB below stipulations faced by the biggest US banks for more stringent stress tests and capital and liquidity requirements, need to be reviewed.

The Fed should not be deterred from raising rates to curb inflation, but it needs to tread carefully. Though the banking system is better capitalised than in 2008, in the coming days similar institutions will come under pressure, and market confidence will be tested. Britain’s pension fund crisis and the crypto chaos of recent months were already emblematic of the risks of rising rates. Trouble will no doubt be brewing elsewhere. This episode is a reminder that regardless of size, when regulators lose sight of systemic risks, even small banks can become too big to fail.

单词积累

- Beneficiaries 受益者

- Bailout 救助

- Mortgage Bonds 按揭债券

- Treasuries 国债

- Securities 有价证券

- Scrutinise 审查

- Inculcate 教育

相关Alevel知识点复习

Moral Hazard (Unit 1 Chapter 18)

Too big to fail (Unit 1 Chapter 18)

银行倒闭属于Market Failure中典型的Moral Hazard,新闻正文中甚至有直接题及这个概念。Alevel中对于Moral Hazard的考察重点更多在于它的定义,考U1的小朋友们可以借机复习一下。

Monetary Policies (Unit 2 Chapter 40)

Interest Rate的调控属于Monetary Policy,调控主体为每个国家的Central Bank