我们在上篇文章中,已经大概了解了今年全球大部分国家面临的问题——通货膨胀。也了解到了在面临通货膨胀时,各国政府会采取措施来应对高涨的物价上升对人们生活水平带来的负面影响。

要解决高通货膨胀,政府的宏观政策主要有三个:

① monetary policies-货币政策

② fiscal policies-财政政策

③ supply-side policy-总供应相关政策

Monetary policies

refers to the use of interest rates, exchange rates and the money supply to control macroeconomic objectives and to affect the level of economic activityMeasures:interest rate, money supply and exchange rate

Fiscal policy

refersthe use of taxes and government spending to affect macroeconomic objectives such as economic growth and employmentMeasures:taxation and government spending

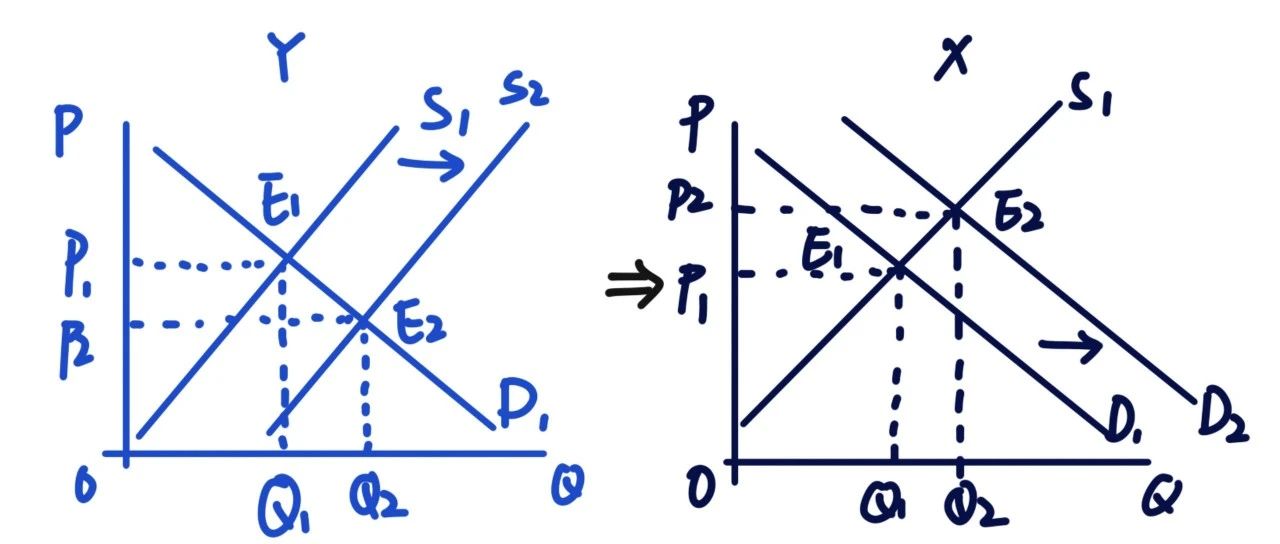

为了解决由于总需求AD上升导致的demand-pull inflation,一般需要使用能够降低AD的contractionary policy收缩性政策。

a)Contractionary monetarypolicy: increase interest rate, reduce money supply and increase exchange rate

b)Contractionary fiscalpolicy: increase tax rate and reduce government spending

Supply-side

referslong-term measures to increase the productive capacity of the economy, leading to an outward shift of the production possibility curve.Measures:

Education and training

Taxcut

Subsidy

Labour market reforms

Deregulation

Privatisation

Improveinfrastructure

supply-side policy可以通过降低cost of production的方式,来增加aggregated supply,从而降低物价。主要解决cost-push inflation。

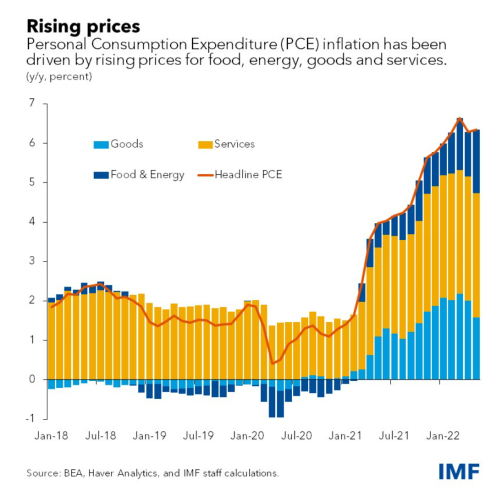

让我们看看在面临40年来最高通货膨胀时美国是如何应对的

美国经济在疫情期间采取宽松政策刺激总需求后,经济有在复苏,但却因为stressed supply chain due to shutdown of china , Russian war with Ukraine, and ongoing pandemic面临着历史最高通货膨胀。通货膨胀导致油价,食品价格,房价,交通价格等上涨,居民的生活成本大幅上升。

美国主要通过以下四个措施来应对高通胀:

1、tighten monetary policy 也就是紧缩的货币政策。比如提高利率从而减少total demand并遏制价格上涨的压力。今年以来美国加息五次,将联邦基金利率目标区间上调到3%至3.25%之间。

2、在某些商品上通过price control防止价格过高,例如,美国通过白宫3月31日宣布,在未来6个月每天从战略石油储备(Strategic Petroleum Reserve)中释放100万桶,约占全球需求的1%,总释放量可达到1.8亿桶。这是白宫有史以来释放原油储备规模最大的一次。

3、美国还通过改善供应链来抑制通胀。减少对中国和俄罗斯的依赖,建立“Indo-Pacific economic Framework”。

4、2022年8月份,美国总统拜登签署《2022年通胀削减法案》,意在通过减少财政赤字、增加对大企业征税等措施来遏制通胀。

接下来让我们运用所学知识于题目

Discuss whether monetary policy alone is the best way for a government to correct inflation. [12]

解题思路Part 1define relevant key terms

①Inflation; demand-pull and cost-push.②Monetary policy.

Measures

Contractionary and expansionary

③AD=C+I+G+NX.

Part 2explain how monetary policy could solve inflation

Contractionary monetary policy

Increase interest rate →return of saving decreases→saving decreases→ consume expenditure(C) decrease→ AD decreases.

Increase interest rate→cost of borrowing increases→ investment(I) decreases→ AD decreases.

Increase exchange rate→export becomes relatively more expensive and import becomes relatively cheaper→export decreases and import increases →net export (NX) decreases→AD decreases.

Part 3discuss when the monetary policy is ineffective

The effectiveness of monetary policy to correct inflation will depends on a number of factors:①Interest rate may not solve its problems.

time lag.

a higher interest rate also have adverse effect on unemployment and economic growth.

a rise in the interest rate may discourage foreign investment.

②Confidencelevelmay make consumers’ and investors’ behaviours unpredictable.

Part 4compare to another policy: explain how supply side policy could solve inflation

①Define supply-side policy.

②Explain how the policy measures work.

Increasing spending on education and training→improve labour’s skills (human capital)→productivity increases→AS increases.

Reducing direct tax→such as corporation tax→more profit to increase investment→productivity increases→AS increases.

Privatisation→profit-motive→more efficient→AS increases.

Part 5discuss when the supply-side policy is ineffective

Not very effective in the short term as they can take a long time to have an effect.

increased government spending on education and cuts in tax may increase AD before they increase AS.

Privatisation may not result in an increase in efficiency if the privatized industries become monopolies and do not take into account external costs and benefits.

Part 6evaluate which policy is more likely to be successful

If output and employment are low, LARS perfectly elastic, firm can attract more resources without rising price level, decreasing AD without decreasing the price level.

So contractionary monetary policy can be ineffective.

If economy close to full capacity, LARS vertical, contractionary monetary policy is very effective.

Supply-side policy is effective in the long run but it is time-consuming and costly.

Part 7conclusion