If the real estate bubble exploded will it cause significant destruction on The Shanghai economy system and citizens?

如果房地产泡沫破裂,会对上海经济体系和市民造成重大破坏吗?

研究概述

近几十年来,上海房地产业发展迅速。随着资本流入房地产市场,房地产价格的上涨会产生泡沫。人们意识到经济泡沫的存在,但鲜有人探讨如何抑制房地产泡沫的增长。本文从泰国、香港等发生过房产泡沫的案例出发,探究房地产是由投机风险与政府干预等多种因素作用。经过问卷与二手资料的调研,研究者认为遏制房地产泡沫的破灭,政府可以对房地产行业进行调整。一是可以通过提高买卖房屋的手续费来减少房屋交易。其次,我们可以提高房屋质量监督,以减少房屋销售的数量。

作者Author:严哲锴 Zhekai Yan

1.Introduction

In recent decades, the real estate of Shanghai has developed rapidly. With the flow of capital into the real estate market, the rising prices of real estate will creates a bubble. Many people only have a simple understanding of the real estate bubble. At the time,Sun chao (2008) has talked about how to prove that there is a economic bubble in real estate, but do not talk about how to curb the growth of the real estate bubble.

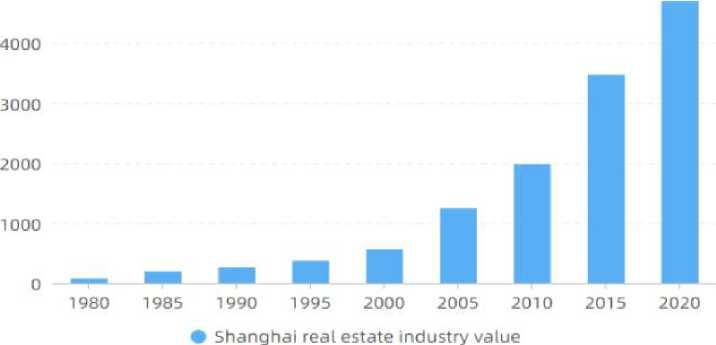

Real estate investment in Shanghai

unit:ten thousands

Figure 1 Shanghai real estate industry value

2.Literature Review

2.1The Definition and Emergence of Economic Bubble

Charlesp Kindleberger (1998)wrote "foam" in the new lexicon Dictionary of Economics: "bubbles can be defined as a sharp rise in asset prices in a continuous process, and the initial price increases give rise to expectations that prices will rise further."

2.2The History of Real Estate Bubble

2.2.1 Thailand Real Estate

The first financial crisis in Southeast Asia started in Thailand. Due to the blind development of the real estate industry, there is a large surplus of houses. In 1986, a large number of foreign funds poured into Thailand, leading to the rapid rise of real estate prices in some major cities in Thailand. In 1989, the total amount of housing loans which was granted by Thailand was THB 145.9 billion. By 1999, it had exceeded 800 billion baht. At that time, real estate investment accounted for half of all investments.

2.2.2 Hong Kong real estate

The real estate bubble of HongKong formed in 1990s. The bubble of the real estate and stock market also brought about an additional fortune of HK $70000(Chinese government, 2021). The bubble had caused the surface prosperity of these economies, but after the financial turmoil in 1997, the bubble burst and the real estate and stock market began to drop rapidly which was resulting in a large number of property shrinking. The explosion which lost about HK $80000 in 5 years from 1997 to 2002 started from the bubble. The main reason for the rapid growth of real estate in Hoong Kong was that the Hong Kong government did not manage it in time and let it develop.

2.3 Factors that affect the real estate bubble

According to (Kevin Hassett ,2003) the economic bubble is an outcome of an unbalanced economy resulting from various factors, which are listed as below.

- Companies of real estate is expected that if everyone expects a certain commodity such as real estate, to be very optimistic, many people will choose to buy and lead to bubble growth. In another way, the attraction of developers in the expectation of higher profits will reduce the current supply in the market.

- People's herd mentality in investment behaviors. When much more intense the price changes are, the greater the psychology of conformity will be, the more irrational bubbles will also grow.

- The risk of speculation. Speculation will make the high waste of house , and lots of house have be sell and only some people can able to purchase house to live.

- Lack of government control. The lack of timely national regulation results in the rapid growth of bubbles and failure in maintaining the market stability of real estate.

2.4 Research on Real Estate Market of Shanghai

Many researches on the real estate bubble in China concluded that the real estate industry bubble can not be properly solved, and the burst of bubbles not only lead to the decline of real estate industry, but also the whole economy even the whole society(Sun Chao 2008). However, few scholars studied on how to solve or stop the growth of bubbles. Sun Chao (2008) stated in his study on the real estate price in Shanghai that there were several reasons for the formation of Shanghai's real estate bubble. And the floor space completed increasing to now ,also the space construction are also increasing .

3.Results

3.1 Reasons for the growth of Shanghai's real estate bubble

3.3.1 People's high investment expectations

First of all, in recent years, with the faster and faster development of Shanghai's real estate industry, people's effective demand for houses is stronger than that in previous years. In 1998, the government chose real estate as the key point of policy in order to stimulate growth.And by reason of Shanghai government rapid growth the real estate industry , the proportion of real estate in total GDP in increasing from 2% in 1993 to8%in 2004.

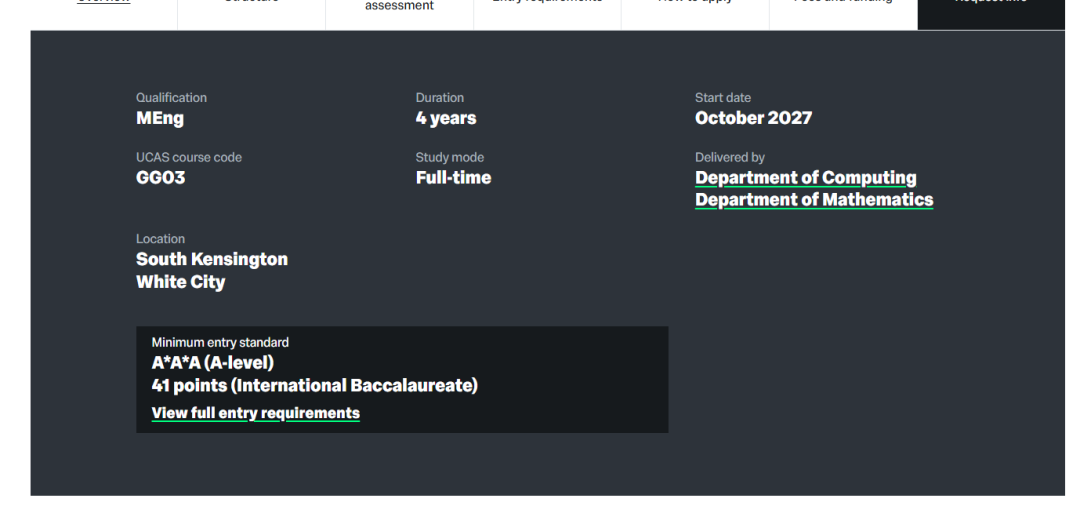

3.3.2 The Unbalance of Real Estate Stock and Increment

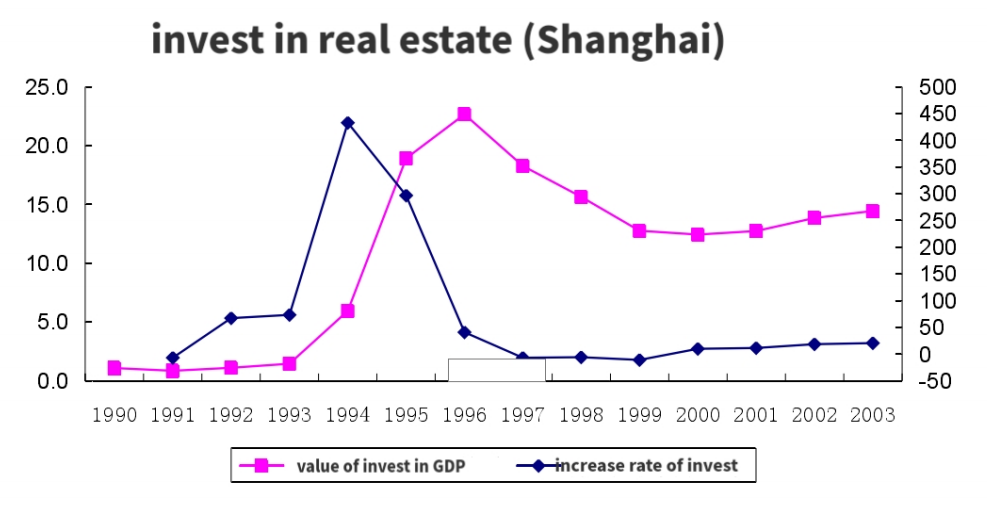

The real estate stock and increment are seriously unbalanced. The development of the secondary market is slow and most of the new real estate demand is in the incremental real estate market which raises the house price.That on 1993 to 1994 most money flow in to real estate industry , and the value increase very fast.(Shanghai Bureau of Statistics,2003)

Figure 2 Invest in Real estate(Shanghai)

3.3.3 Insufficient and Inadequate Supply to Different Income Levels

The real estate industry is mostly supplied to high-income people. The supply to low-income and middle-income households is insufficient. And also made a large part of real estate have a high vacancy rate.The sale area are increase very quickly in 1994 to now and the second hand house are not sale very much.

3.2 Measures to control the real estate bubble

In my opinion of how to control real estate bubble is the control of the real estate bubble is mainly led by the government, first of all, it can increase the tax on real estate transactions, thereby reducing the transaction in the real estate market. Secondly, the number of real estate manufacturers can be reduced by controlling the area of land sold.

4.Conclusion

The development cycle of Shanghai's real estate bubble can be divided into three stages: preparation stage; Slow development stage; Rapid development stage. Today, the real estate industry in Shanghai is in the stage of rapid development. At the same time, it has been in this stage for about 30 years.

In my opinion of contain the burst of bubble in real estate, the government can make adjustments to the real estate industry. First, it can reduce housing transactions by increasing the handling fee of buying and selling houses. Secondly, we can improve housing quality supervision to reduce the number of housing sales.

Bibliography

Chinese government, 2021. About real estate. [Online] Available at: https://data.stats.gov.cn/ Qi hang, 2019. About companies of real estate. [Online] Available at: http://m.jia.com/zixun/jxwd/647375.html?from=smwd [Accessed 18 June 2021].

Sun chao, 2008. Research of Shanghai real estate. Research of Shanghai real estate, p. 8-9.

CHARLESP KINDLEBERGER, 1998. The New Palgrave Dictionary of Economics. New York: The New Palgrave. Gourdin, 2019. Real estate price in Japan. [Online] Available at: https://www.ceicdata.com/zh-hans/indicator/china/house-prices-growt h [Accessed 27 June 2021].

Keynes, 1983. Theory of Money. Britain: Business Press.

Li Fang, 1998. Financial bubble theory. China: Shu Lun Pan CPA Co. Ltd.

State Statistics Bureau, 2003. China Statistical Yearbook. China: China Statistics Press. People's Bank of China, 2003. China Housing Finance Report. China: Zhong xing press.

Shanghai Bureau of Statistics, 2003. Shanghai Statistical Yearbook. China: China Statistics Press.

Kevin Hassett, 2003. Bubble . USA: Zhong Xing Press.